pay indiana sales tax online

While she wont collect sales tax on the repair service she will be required to collect sales tax on the components she sells. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

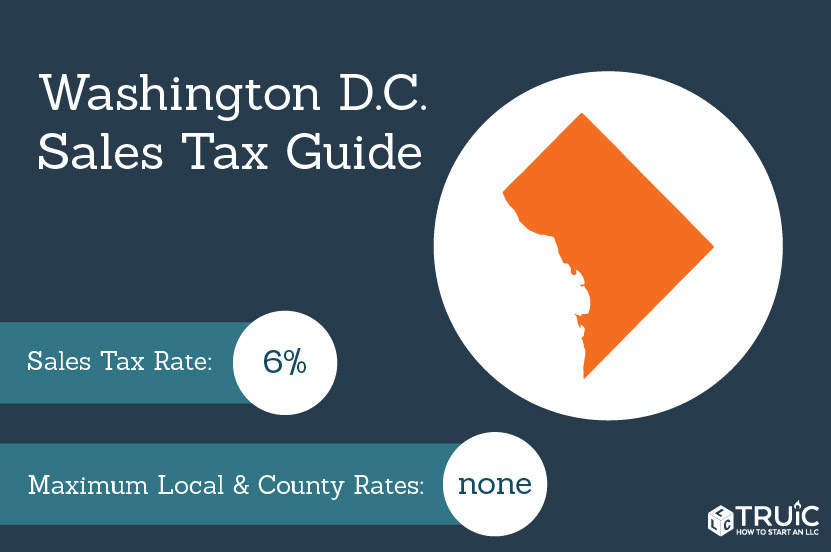

Counties and cities are not allowed to collect local sales taxes.

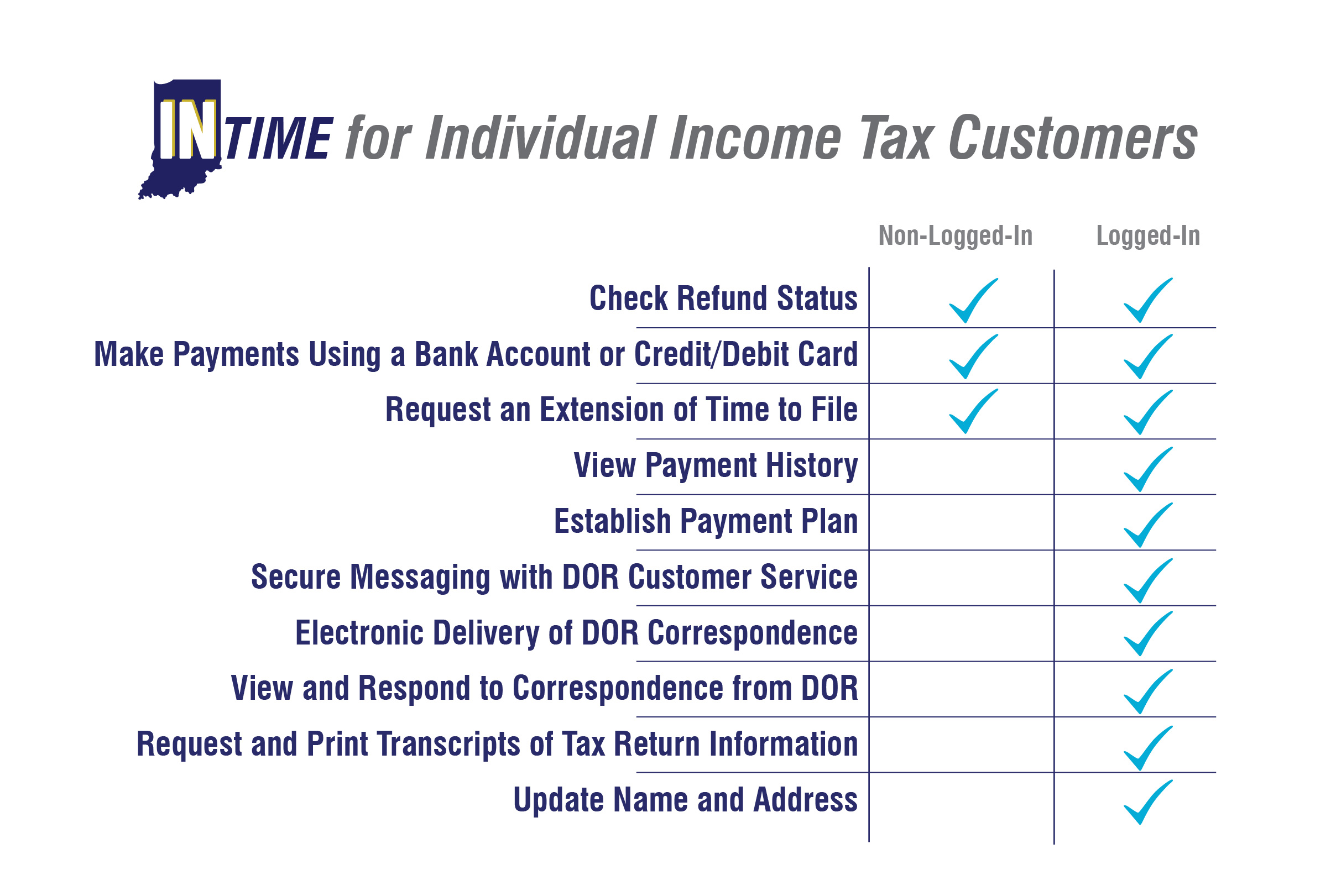

. Have more time to file my taxes and I think I will owe the Department. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Please contact the local office nearest you.

Of the 20th day of the month after the end of the filing period. Groceries and prescription drugs are exempt from the Indiana sales tax. States and Washington DC.

Pay my tax bill in installments. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage tax accounts in one convenient location at intimedoringov. Estimated payments can be made by one of the following methods.

All other business tax obligations corporate or business customers with sales and withholding tax obligations have migrated to the Indiana Taxpayer Information Management Engine INTIME. A seller must know the local tax rates and collect them from his or her customers. For those that pay their sales tax due on time Indiana will offer a discount as well.

We cover more than 300 local jurisdictions across Alabama California Colorado Kansas Louisiana and Texas. 2022 Indiana state sales tax. Sales and Use Tax Online Filing and Payments.

You can contact DOR for help with INtax to manage the tax obligations listed above at 317-232-2240 Monday through Friday 8 am. Net 20 Days More than 1000 per month. Online videos and Live Webinars are available in lieu of in-person classes.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Taxpayers who paid 500000 or more for any specific tax are required to transmit payments using TEXNET. Sales tax is a small percentage of a sale tacked on to that sale by an online retailer.

If you paid 500000 or more. Available sales tax eForms. Net 30 Days Less Than 1000 per month.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. Click here to watch a step-by-step video on creating. Sales and use tax television and telecommunications sales tax and consumer use tax can be filed and paid on the Tennessee Taxpayer Access Point TNTAP.

The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax. Businesses impacted by the pandemic please visit our COVID-19 page Versión en. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

INTAX only remains available to file and pay special tax obligations until July 8 2022. Juanita is opening a computer store where shell sell components parts and offer repair services. Claim a gambling loss on my Indiana return.

Whether youre a large multinational. Business Online Services Account - just log in to your account and select File Pay Taxes and select the tax type you need to file or pay. Know when I will receive my tax refund.

INtax only remains available to file and pay the following tax obligations until July 8 2022. If you have more questions about sales tax you may call our sales tax information line at 317 232-2240. Find Indiana tax forms.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. All sales and use tax returns and associated payments must be submitted electronically. Many states that collect sales tax also exempt certain itemslike food productsfrom taxation.

If you have not yet filed your tax return when you reach the File section you have the option to either have the amount due debited from your bank account or you can select the option to mail a checkOr you can use the link below to pay your state taxes due. Take the renters deduction. See Available Tax Returns.

Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at retail. For example in California the statewide sales tax rate was 725 in 2021 and local districts can impose their own additional sales taxes. For questions about filing extensions tax relief and more call.

Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. For additional information see our Call Tips and Peak Schedule webpage. Quarterly Sales and Use Tax Returns are due before 1159 pm.

Create a Tax Preparer Account. If you paid 10000 or more for the following. Find Indiana tax forms.

Claim a gambling loss on my Indiana return. The discount varies depending on the size of what was collected. ATTENTION-- ALL businesses in Indiana must file and pay their sales and withholding taxes electronically.

To register for Indiana business taxes please complete the Business Tax Application. How do i pay state taxes electronically for Indiana on epay system. Know when I will receive my tax refund.

Have more time to file my taxes and I think I will owe the Department. All have a sales tax. INTAX only remains available to file and pay the following obligations until July 8 2022.

You can find your amount due and pay online using the intimedoringov electronic payment system. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales. If you work in or have business income from Indiana youll likely need to file a tax return with us.

Taxpayers who paid 100000 or more must report electronically through Webfile or EDI. Exact tax amount may vary for different items. June 5 2019 250 PM.

You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. View account history and schedule payments in advance up to the due date.

There is no need to copy information from one form to the next. Gasoline Use Tax - GUT. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7.

Lets start with the basics of ecommerce sales tax. You do not have to wait until the due date to file. For more information on the modernization project visit our.

If the due date falls on a weekend or legal holiday the return and payment are due on the following business day. Pay my tax bill in installments. Simply fill in the requested fields.

County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1. For those collecting less than 60000 per year the discount is 0083. Take the renters deduction.

A TNTAP logon should be created to file this tax.

District Of Columbia Sales Tax Small Business Guide Truic

Rosign 1287653 Sans Serif Font Bundles In 2022 Download Fonts Beer Label Serif Fonts

Sales Tax By State Is Saas Taxable Taxjar

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms State Tax Chart

Pin On Svg Commercial Cut Files

W12 Form Indiana 12 Thoughts You Have As W12 Form Indiana Approaches Tax Forms Income Tax Feeling Words List

Bare Root Strawberry Plants Blueberry Plants For Sale Indiana Berry Plymouth In Customer Blueberry Plants For Sale Blueberry Plant Black Currant Plant

Recently Amazon Com Announced That It Would Begin Collecting Sales Tax For Sales In Some States Today From The Vault Money Smart Week Smart Money State Tax

Reciprocal Agreements By State What Is Tax Reciprocity Payroll Taxes Tax Refund Agreement

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Payment Agreement Letter Between Two Parties Contract Template Payment Agreement Simple Business Plan Template

York Maine States Preparedness

Vichy Dermafinish Corrective Stick Opal 15 Read Ebay In 2022 Vichy Fragrance Free Products Paraben Free Products

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Tax Return Estimated Tax Payments

Get Ready To Pay Sales Tax On Amazon Amazon Sale Sales Tax Amazon Purchases