does portland oregon have sales tax

True Oregon has no sales tax so if you buy a 100 pair of shoes it will cost 100 not 109 - as it would in CaliforniaAnd other than in two towns in Oregon one of them is Yachats on the coast there is no tax on restaurant meals either. Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others.

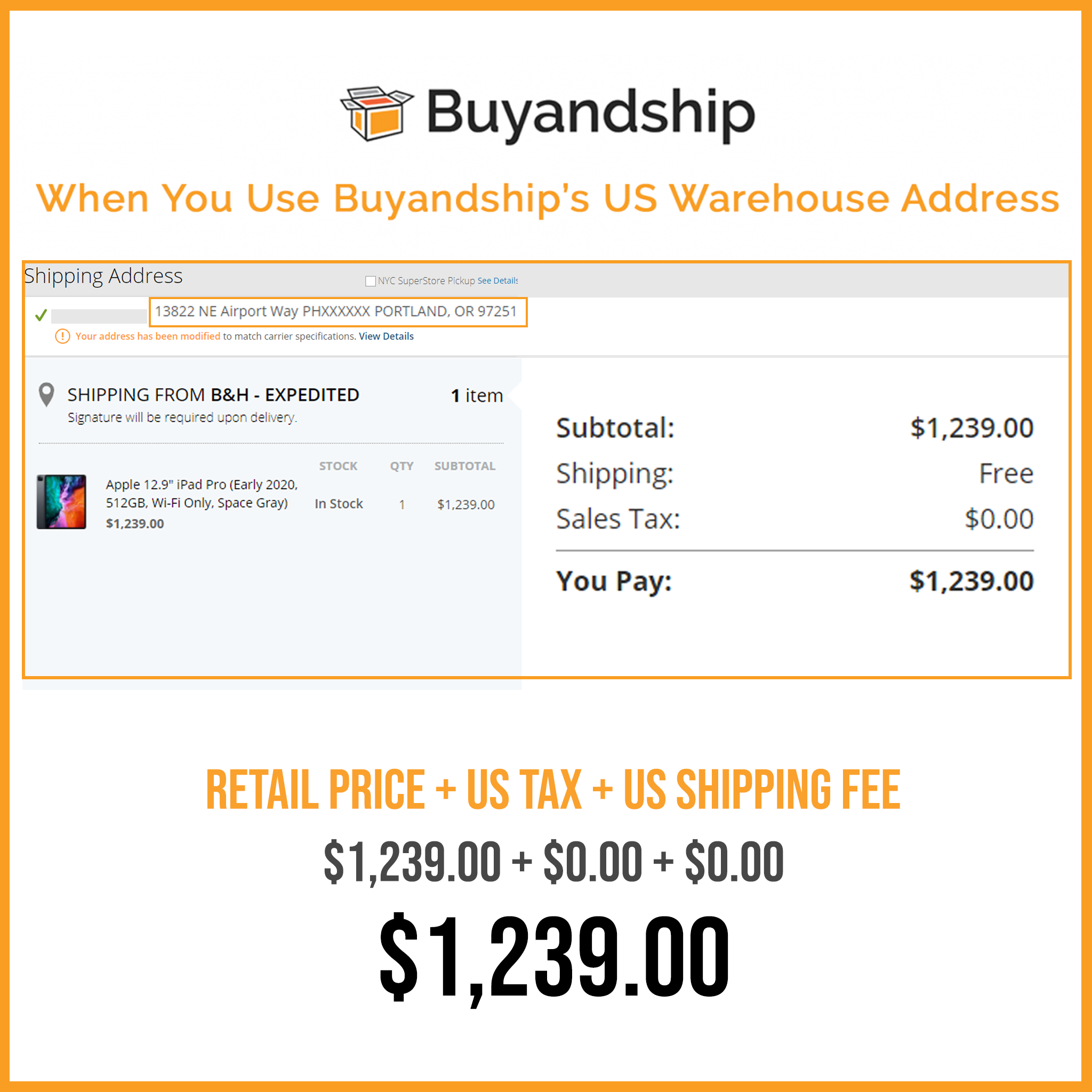

How Our Us No Sales Tax Feature Helps You Save More Money Buyandship Philippines

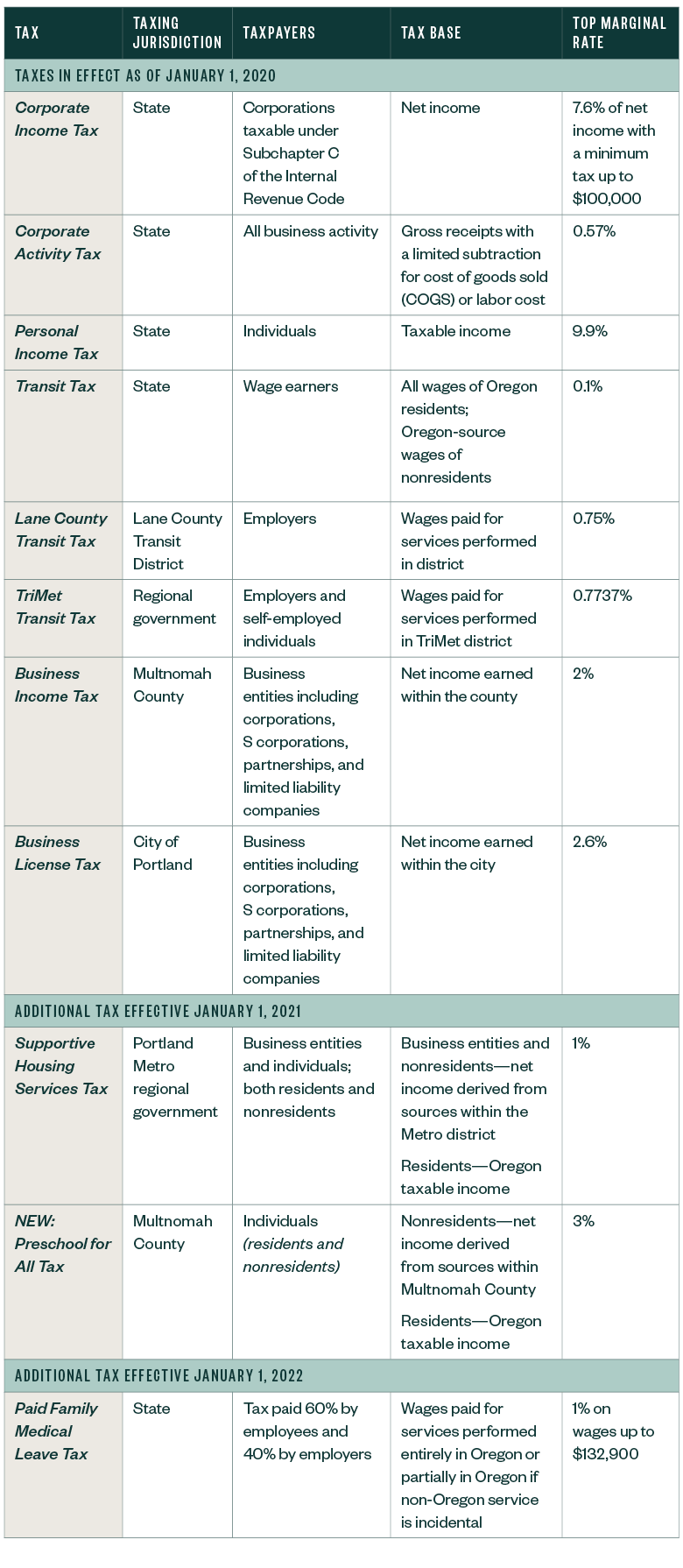

Taxfilers must file their business tax returns and pay their business tax liability at the same time they file their federal and state income tax returns.

. Occupancy taxes for hotels BBs and vacation rentals. This is the total of state county and city sales tax rates. The tax must be paid.

Though there is no state sales tax Oregon was noted in Kiplingers 2011 10 Tax-Unfriendly States for Retirees due to having one. For years Washington lawmakers have been eyeing the automatic sales tax exemption for shoppers from places like Oregon with no sales tax. However as opoppa pointed out youll still pay room tax on lodging which as a general figure is about 10 on top of the quoted room price.

2 assessment on lodging establishments with 50 or more rooms. Portland which belongs to the state of Oregon doesnt impose a sales tax. However there are a number of cities and counties that have their own sales taxes in addition to the state sales tax.

Do any cities in Oregon have sales tax. The Oregon OR sales tax rate is currently 0. Does Portland have sales taxes.

The minimum combined 2022 sales tax rate for Portland Oregon is. The Oregon sales tax rate is currently. The tax rate is composed of several separate taxes as follows.

The personal income tax rate is 15 on Multnomah County taxable income over 125000 for individuals or 200000 for joint filers and an additional 15 on Multnomah County taxable income over 250000 for individuals or 400000 for. Effective January 1 2021 two new Oregon local income taxes apply the Portland Metro Supportive Housing Services Income Tax and the Multnomah County Preschool for All Income. The system applies both to local and state levels meaning you wont be levied for.

Sales Tax Handbook Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to. Oregon doesnt have a general sales or usetransaction tax. View City Sales Tax Rates.

This rate changes to 217 per retail container on July 1 2022. However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. Exact tax amount may vary for different items.

Please contact one of our Oregon tax partners. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. Business Tax Return Filing Requirements.

Rates include state county and city taxes. The latest sales tax rates for cities in Oregon OR state. 20702 cents per 1000 board feet for the Oregon Forest Practices Act.

10249 cents per 1000 board feet for the Forest Research and Experiment Account and Forest Research Laboratory. This year the move to. Moist snuff includes any form of tobacco that is not intended to be smoked or placed in the nasal cavity.

Special taxes such as. Portland Clean Energy Initiative. 625 cents per 1000 board feet for benefits related to fire suppression.

View County Sales Tax Rates. Last updated August 2022. All other tobacco products including inhalant delivery systems 65 percent of the wholesale sales price.

2020 rates included for use while preparing your income tax deduction. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. The County sales tax.

The surcharge tax generally would be 1 of the current years adjusted numerator. Arts Education and Access Income Tax Arts Tax Business taxes for Portland and Multnomah County. The retailer should deduct the amount of Exempt Sales and Portland business tax paid from the current years adjusted apportionment factor numerator.

What cities in Oregon have a sales tax. The minimum tax is 214 per retail container. Portland Tourism Improvement District.

There are no local taxes beyond the state rate. 2022 Oregon state sales tax. In Oregon the statewide sales tax is 05.

Sales tax generates revenue for state-wide operations but five states currently do not impose a state sales tax including Alaska Delaware Montana New Hampshire and.

Oregon Recreational Marijuana Tax Revenue Surged In 2019 Portland Business Journal

What Is The Real Cost Of Living In Portland 2022 Bungalow

New Portland Tax Further Complicates Tax Landscape

25 Free And Cheap Things To Do In Portland Oregon A Fun Budget Escape Homeroom Travel

Why Is There A 1 Percent Tax On My Winco Shopping Receipt Portland Oregon Kgw Com

Oregon Sales Tax To Pay For 750 Monthly Checks To Poor The Oregon Catalyst

Do Oregon Residents Pay A Sales Tax On Cars In Washington

These States Have The Highest Income Tax Rates

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

The Week Observed April 22 2022 City Observatory

Oregon S New Commercial Activity Tax The Cpa Journal

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

Portland City Council Unanimously Approves Additional Tax On Hotel Stays Oregonlive Com

Update On Portland And Oregon Tax Deadlines Isler Northwest Llc

Portland Voters Put A 1 Tax On Large Retailers But Some Consumers Are Paying It Too Oregonlive Com

Oregon Senators Push Bill To Shield Small Businesses From Sales Tax Rules Nrtoday Com

Portland Or Travel Guide Tips Conde Nast Traveler

Proposed Tax To Help The Homeless In Portland Ore Tests Voter Mood In Pandemic Los Angeles Times